January: Events are confirming our 3-phase economic scenario

February 9, 2021

After finishing 2020 on a high note, global equity markets started the new year with optimism before losing their momentum during the last week of the month of January, ending essentially flat in local currencies.

Macroeconomic environment

Investors anticipated that the election of two more democratic senators would open the door for President Biden’s large stimulus package. However, vaccine-related news had a dampening effect as headlines revealed several impediments to the global immunization campaign, including manufacturing delays and new contagious variants of the virus. These false starts and setbacks could lead to uneven progress and disappointing economic activity in the first half of the year.

Valuation

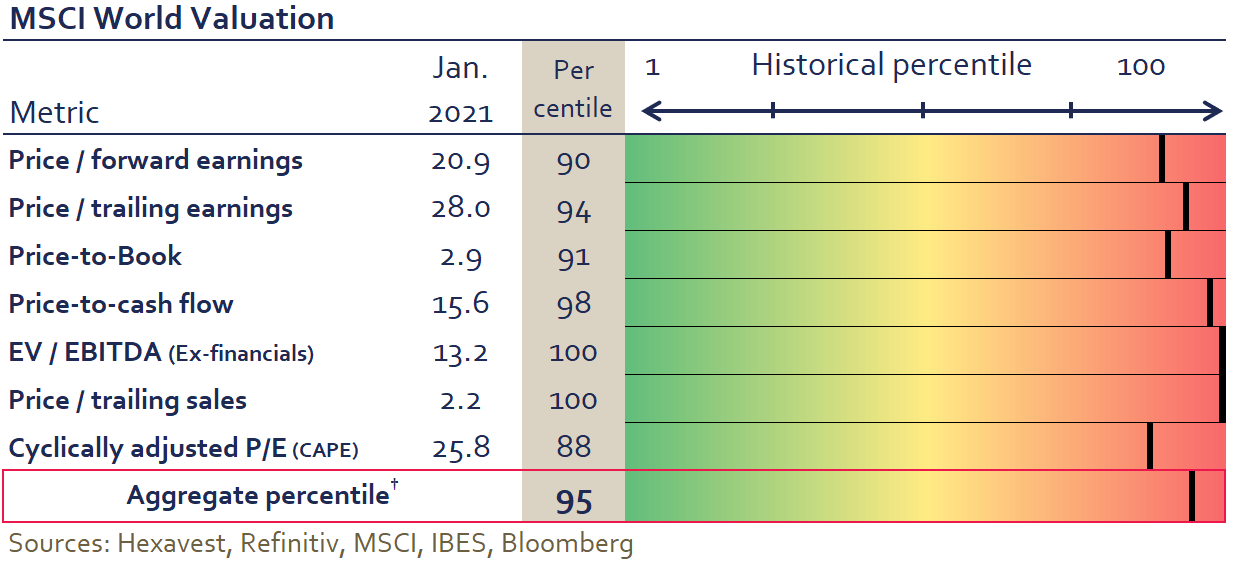

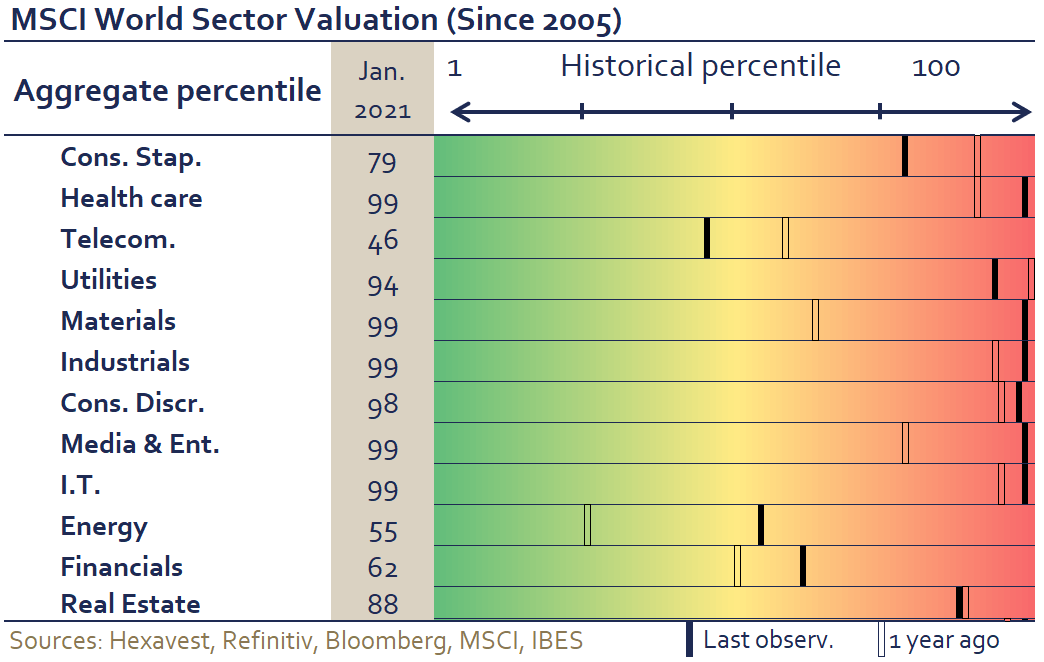

The current speculative mood that is feeding the stock market frenzy is well reflected in valuation metrics. The global equity valuation (MSCI World) remained in the 95th percentile of its historical distribution. From a sector perspective, consumer staples became more appealing: its percentile improved from the 96th to the 79th as prices have not reflected the improved fundamentals. Within materials, profit expectations for metals and mining are well above their pre-COVID levels thanks to higher commodity prices. As a result, the sector’s percentile has slightly decreased from being at one of its most expensive levels.

†Percentile of the average percentile for the seven valuation metrics

Sentiment

Investor sentiment was driven by two factors in January. Initially, institutional investors provided solid support, but the impact of individual investors became more obvious towards the end of the month. They collectively became a powerful force in certain areas of the marketplace thanks to social media platforms, quickly pushing the prices of specific assets. This momentum was facilitated by the access provided by low cost — and sometimes free — on-line brokers that happen to cater to retail investors. While the use of options exacerbated the phenomenon, the result was large price moves and increased daily volatility in the assets that were the target of their attention. This dynamic was reflected in the CBOE Volatility Index (VIX), which is typically used as a measure of the level of uncertainty in the marketplace.

Conclusion

The unfolding events are confirming our three-phase economic scenario over the next 12-18 months and reinforcing our expectation of very volatile markets in the coming months. Near term challenges to economic activity will continue given the weak start to the global immunization campaign. It will take a few months or quarters before a large proportion of the global population starts seeing a return to a pre-COVID life, at which time consumer pent-up demand for services should lead to a cyclical recovery. After the initial rebound, we believe the persistent problem of structural overindebtedness will lead to sluggish economic growth.

We expect that once investors’ euphoria dissipates, the prospects of corporate profitability will be lower than the current levels priced in markets, and the ensuing disappointment will in turn lead to tumultuous markets. Therefore, we are maintaining our prudent stance and defensive positioning.

Important Information and Disclosure

Source of all data and information: Hexavest and MSCI as at January 31, 2021, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced without the written consent of Hexavest.