Investor enthusiasm remains the market’s engine

November 10, 2021

Last month saw investors’ apprehension regarding the slowdown in global economic growth and rising inflationary pressures wane as global equity markets rebounded from the low recorded in early October to reach a new record high.

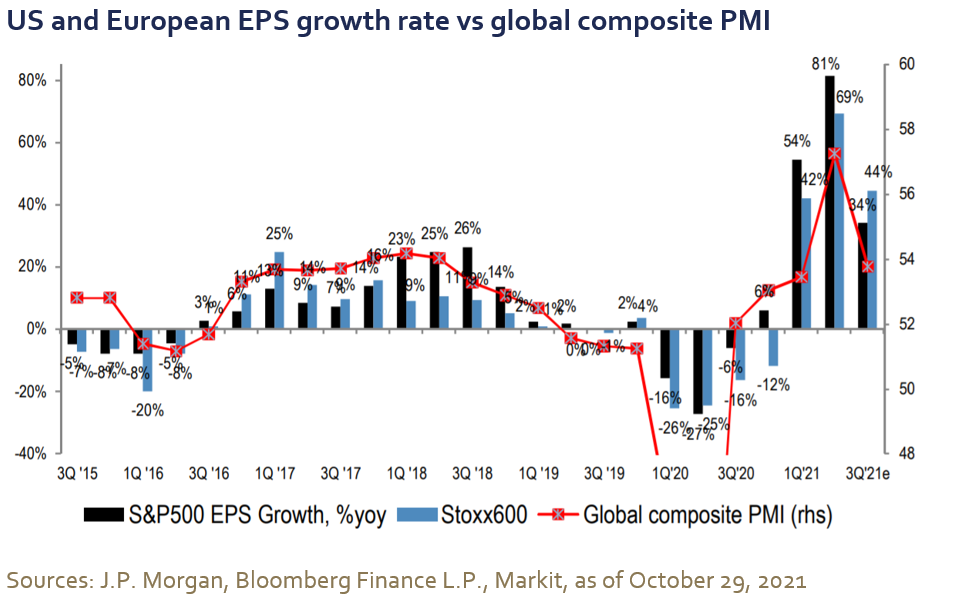

Investors decided to look beyond these issues and supply chain disruptions as earnings results for the most recent quarter demonstrated solid growth. With almost half of the companies in the S&P500 index having reported, earnings grew 34% on a year-over-year basis while sales grew 13%1. Earnings growth was even greater in Europe, with a 44% annual gain for the Stoxx 600. There is no denying the results are impressive, but growth likely peaked last quarter. This was largely expected, as the earnings surprise factor was the lowest in a year.

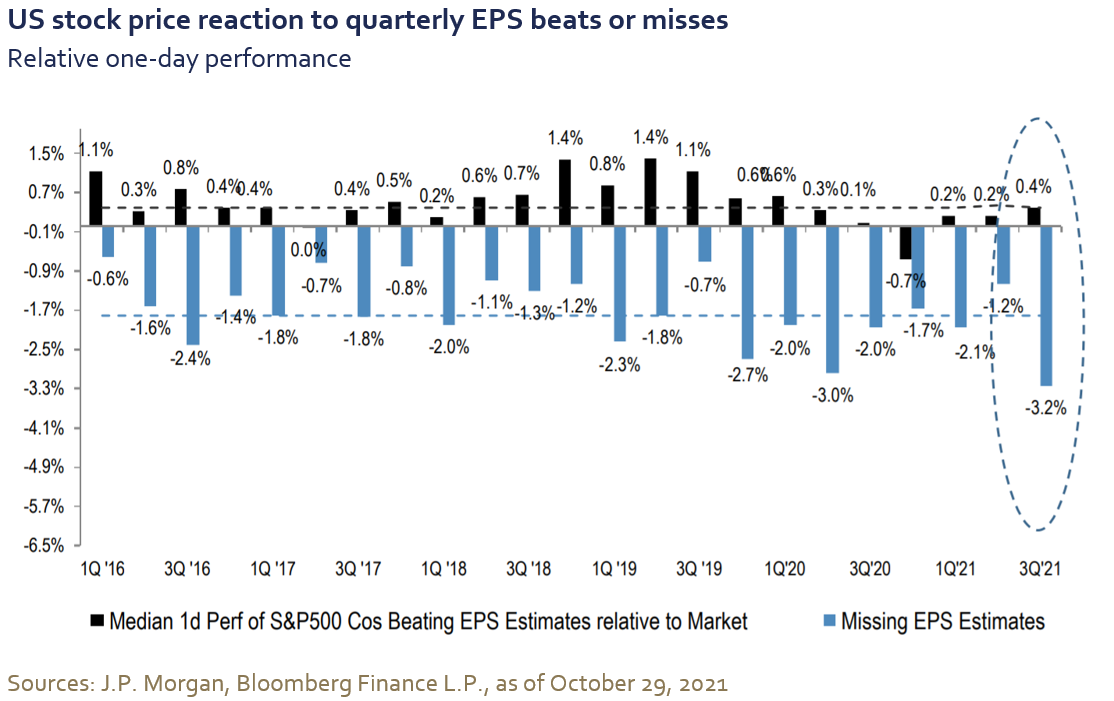

Given their high expectations, investors showed no mercy to companies that missed earnings or provided disappointing guidance. In both the US and Europe, the stock price of companies that missed earnings fell the most in five years this quarter.

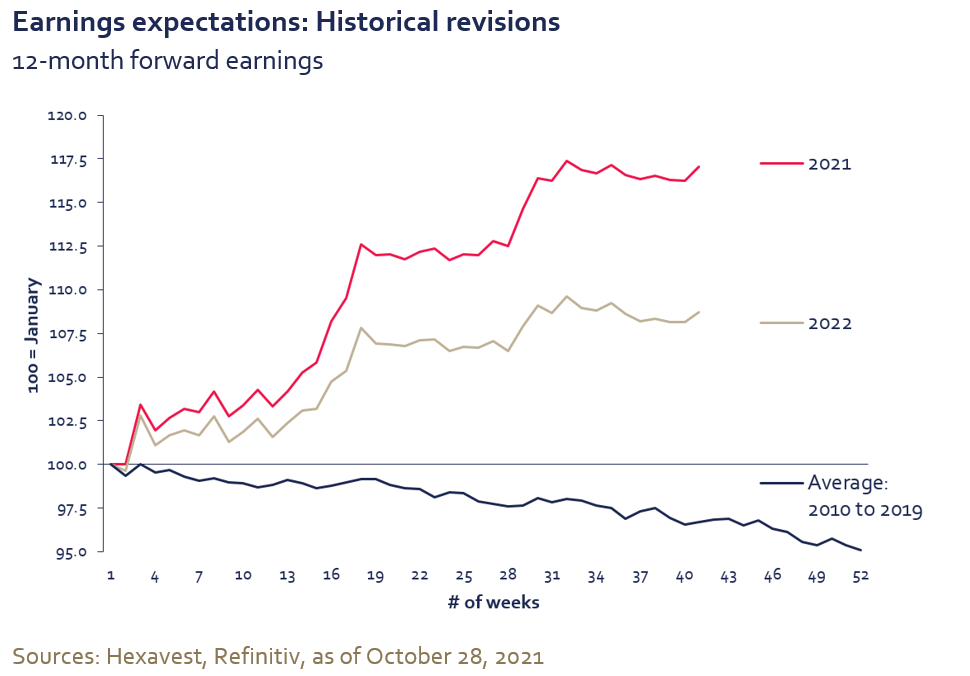

The longer the economic slowdown and supply chain disruption persist, the greater the risks to earnings expectations. Historically, expectations are consistently revised lower throughout the year, but the rapid economic recovery in the first half of 2021 led to significant upward revisions. Surprisingly, expectations have not budged despite the recent slowdown in activity and downward revisions to economic growth forecasts. According to Bloomberg (as of October 29, 2021) economists’ median forecasts for 2021 US real GDP went from 6.5% in the summer to less than 5.5% now. Over the same period, the consensus for 2022 US real GDP was revised downward, from 4.3% to 4%. Nevertheless, analysts continue to extrapolate strong growth in 2022 and expect the current headwinds linked to inflationary pressures and supply chain disruptions to be short-lived. This is a clear risk for the markets going into year-end.

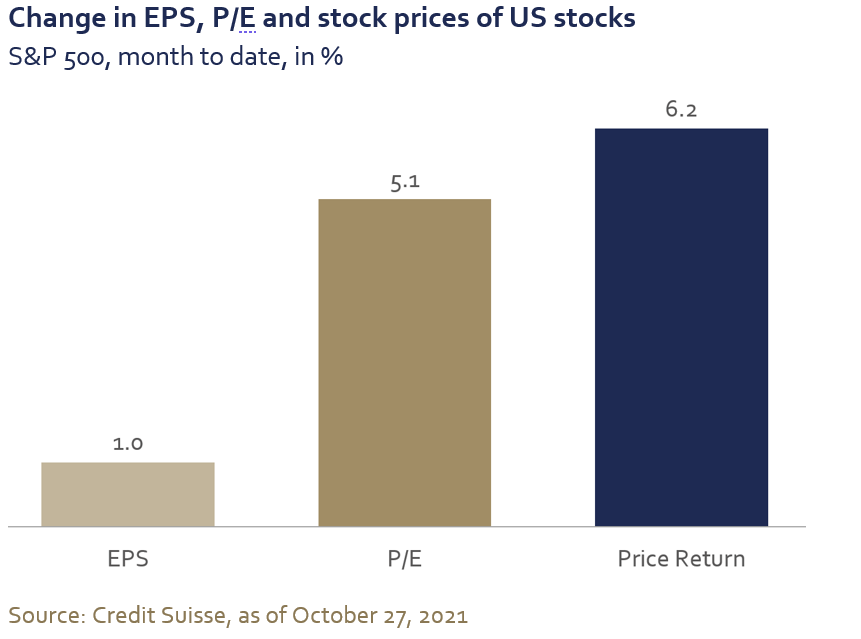

It does not appear as though investors are overly concerned with high valuation multiples. In October, multiple expansion was behind the bulk of the equity market returns as investors pushed high valuation multiples even higher.

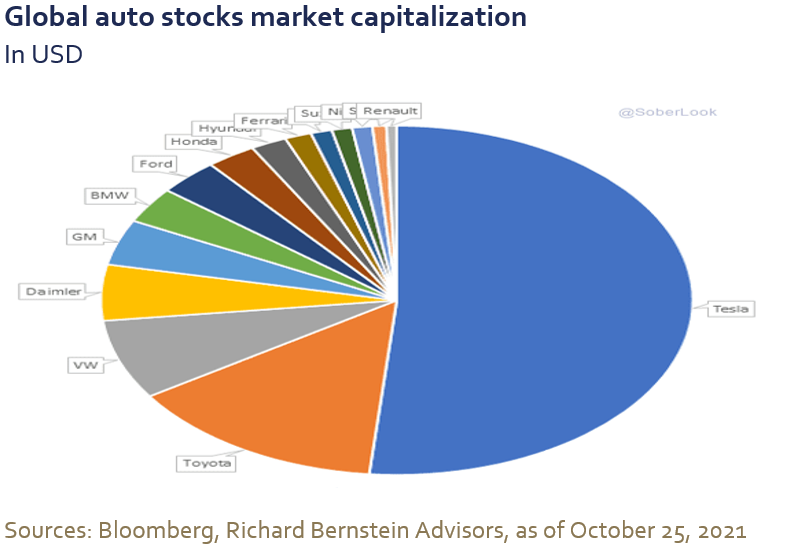

There are many examples of exuberance in financial markets, but one that stands out to us is Tesla. In fact, by the end of October, Tesla’s market capitalization was greater than all other OEM worldwide, even though it realized only 36% of GM’s revenues in the previous four quarters.

Market performance

Global equities (MSCI ACWI Index) rose 4.9% in October in local currencies as buyers returned to the market following the largest equity drawdown since November 2020. The North American market led the way with US and Canadian equities gaining 7.0% and 5.0%, respectively. Asia Pacific trailed with a 0.6% loss as the MSCI Japan Index fell 1.2%. Europe gained 3.7% as both British and German equities lagged with a 2.3% gain. The ongoing uncertainty due to global trade and supply chain disruptions continue to weigh on the German economy, which is heavily dependent on the automotive sector.

Cheap cyclical sectors did well last month. The energy sector gained 5.8% while a strong rally in Tesla (+43.6%) propelled the consumer discretionary sector higher (+8.1%). Despite a rise in treasury yields—the US 10-year bond yield advanced from 1.49% to 1.59%—technology stocks gained 6.7%. The communication services sector was the biggest underperformer last month with a small 1.6% gain, while the defensive sectors fared only slightly better, up 2.6% for consumer staples and 3.5% for healthcare.

Conclusion

Considering our assessment of our three vectors—macroeconomic environment, valuation and investor sentiment—we continue to believe financial markets have run too far ahead of fundamentals and that stretched valuation and sentiment indicators leave little room for disappointment.

We welcome any questions or comments you may have. We can be reached at service@hexavest.com

Source:

- P. Morgan, Global Equity Strategy, Q3 Earnings Season Tracker, October 29, 2021

Important Information and Disclosure

Source of all data and information: Hexavest and MSCI as at October 31, 2021, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

All references to the “Hexavest ACWI equity portfolio”, to the “ACWI Equity representative portfolio”, to the “portfolio”, or to their performance in this document refer to an actual portfolio managed by Hexavest which is used to objectively represent the firm’s Global ACWI Equity strategy. The performance of this representative portfolio has been included in Hexavest’s ACWI Composite (Composite) since its inception in 2014. The Composite includes portfolios that invest primarily in equities of companies located in the developed markets and emerging markets of Americas, Europe & Middle East, and Asia Pacific. Hexavest uses an investment approach that is predominantly “top-down” to construct diversified portfolios that typically contain more than 275 stocks. Asset allocation between regions, countries, currencies, and sectors can deviate substantially from that of the benchmark. Some portfolios may invest a small portion of their assets in countries and currencies not included in the benchmark. A client’s actual holdings, performance and investment experience will be different from that shown.

Gross-of-fee performance results are presented before management and custodial fees but after all trading commissions and withholding taxes on dividends, interest, and capital gains, when applicable. Such fees and expenses would reduce the results shown. Fee levels may vary from client to client depending on the portfolio size and the ability of the client to negotiate fees.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable. Investing entails risks and there can be no assurance that Hexavest will achieve profits or avoid incurring losses. It should not be assumed that any investor will have an investment experience similar to returns shown.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest.