Asian tech demystified

August 2, 2019

Jean-Benoit Leblanc

The technology sectors – semiconductors, electronic components, computers, software, computer services and so on – were long the prerogative of a few developed countries. The role of emerging markets was mainly to consume Western technology and to produce low-value-added goods.

Now, the four Asian Tigers – Hong Kong, Singapore, Taiwan and South Korea – have become veritable technology hubs. These markets form global manufacturing and assembly chains for many electronic components, especially semiconductors. Two of the four tigers, Hong Kong and Singapore, are now considered developed markets, while MSCI still ranks the other two, South Korea and Taiwan, as emerging markets.

Technology represents a substantial share of the MSCI stock indexes of these countries: about 60% for Taiwan and more than 45% for South Korea, with the semiconductor and IT hardware segments being predominant. As for China, it has embraced Internet-related technologies and taken advantage of its rapidly expanding domestic market to create true e-commerce, video games and social networks giants.

In this article, two members of our emerging markets team demystify the composition and evolution of this sector and explain why they consider it an attractive investment theme.

An Overdue Reclassification

As consumers massively adopt different technologies, some of them become commonplace or are absorbed by other sectors. In 2018, MSCI therefore overhauled the classification of technology stocks, which are now split into three sectors:

- Information technology now tends to consist of South Korean and Taiwanese computer hardware companies and Indian IT service companies;

- Chinese e-commerce securities, such as Alibaba, have joined the consumer discretionary sector; and

- Chinese interactive media securities, such as Tencent, are now part of the more traditional telecom securities in the communications services sector.

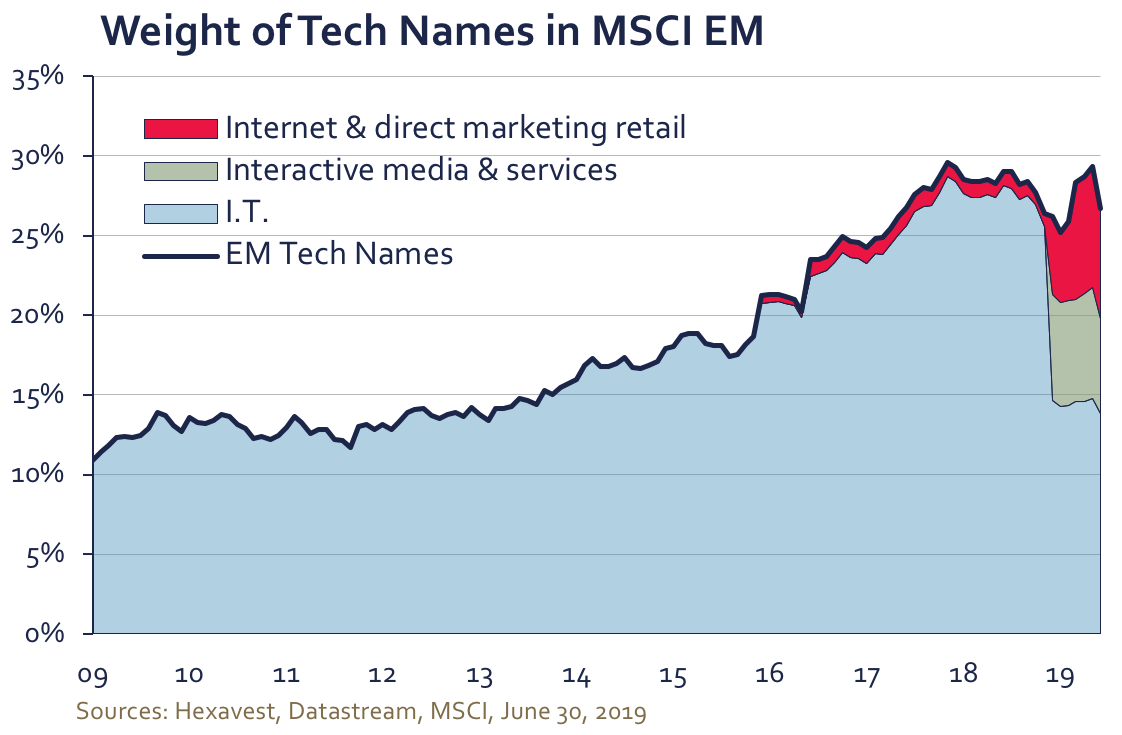

In the graph below, we have reconstituted the weight of technology stocks by illustrating the changes following MSCI’s recent classification. The rise of technology in emerging markets over the past decade, from about 11% to about 27% of the MSCI Emerging Markets Index, is impressive and reflects profound change. The weight of the computer hardware/semiconductor/software segments has increased by about 40% in 10 years, but the rapid emergence of Internet stocks is even more remarkable.

The remainder of this article will focus on the segment that MSCI left in the IT sector, namely computer hardware and semiconductor companies. This segment remains the most cyclical because semiconductors have been subject to global cycles for several decades.

Significant Performance Variations

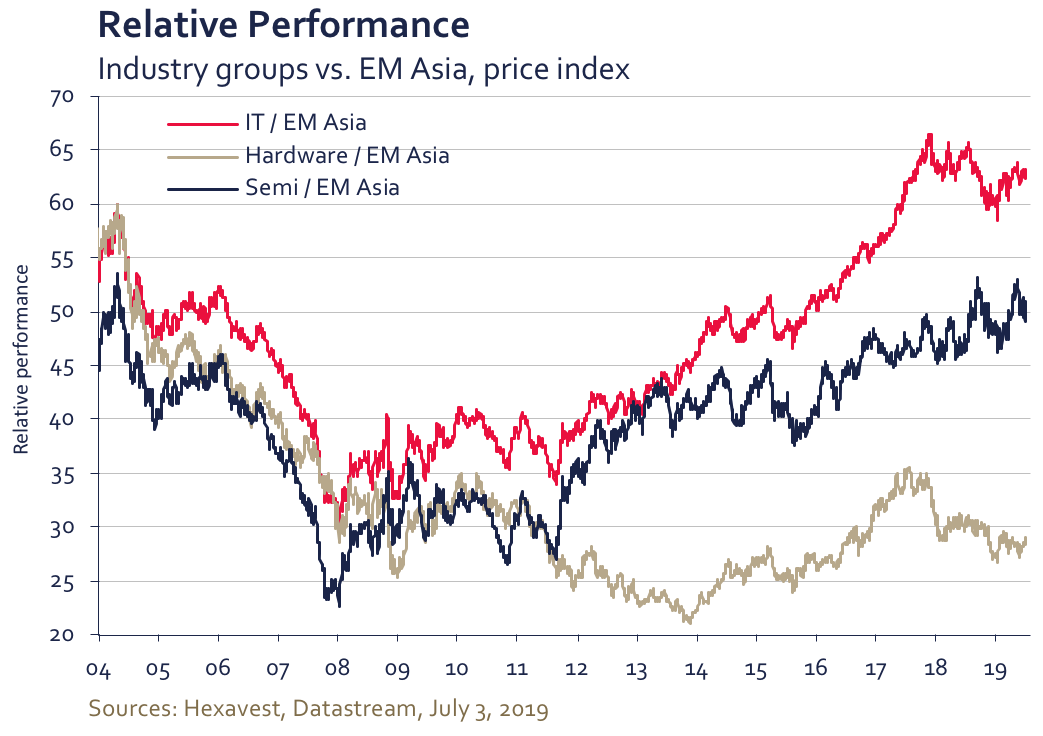

Computer hardware and semiconductor shares account for about 12% of the MSCI Emerging Markets Index. Contrary to what we see in developed markets, these two industries are highly concentrated, with only two securities, Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC), accounting for 60% of stock market capitalization. Even though the technology sector has outperformed the broad market since the 2008 crisis, significant variations have been observed for the different segments of the sector, as shown in the graph below.

Over the past decade, Internet securities contributed the most to the IT sector’s outperformance (until they were reclassified by MSCI). As for semiconductors, with TSMC in the lead, they have benefited from such phenomena as the rise of smartphones around the world, the constantly growing memory capacity of electronic goods, and the use of cloud-based services by consumers and businesses alike. As for the performance of computer hardware companies, it has been solid but less spectacular. The players in this segment are numerous, they often specialize in one product or component and they are under constant pressure from customers to lower their prices.

A Cyclical Growth Market

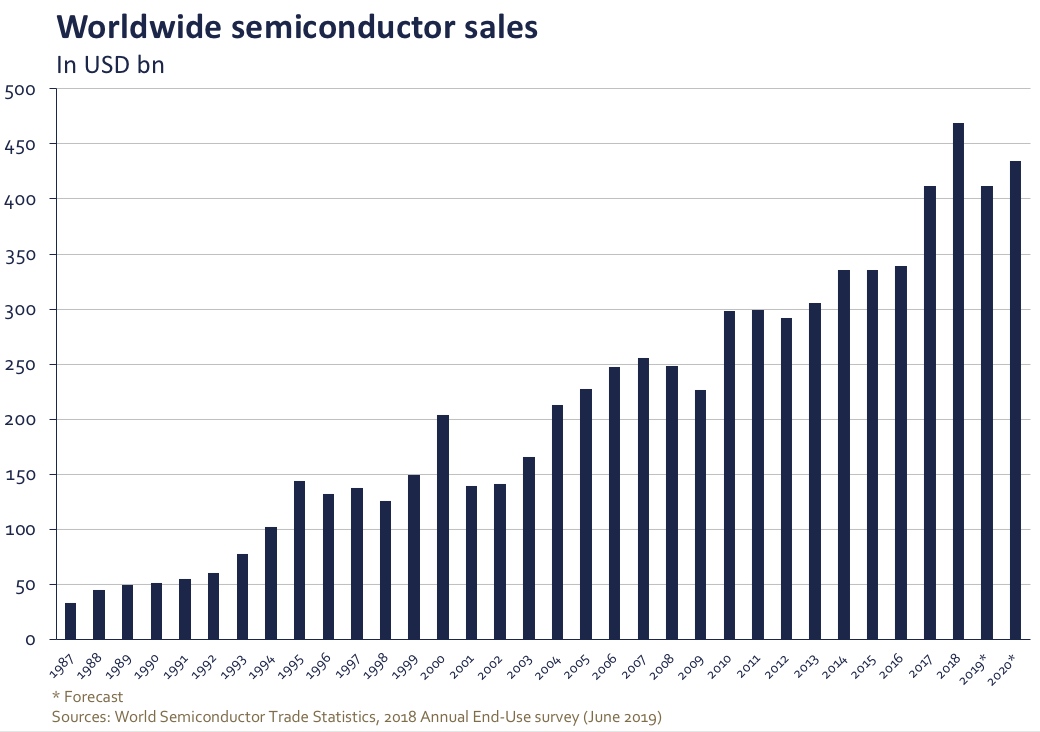

Semiconductor sales have almost tripled in the past 20 years, reaching $469 billion in 2018.

How can such growth be explained? Moore’s Law, which is more than 50 years old and deals with changes in the computing power of computers, still explains, in our view, the exponential increase in the need for semiconductors. In 1965, Gordon Moore, who would become the co-founder of Intel, predicted that the number of transistors in an integrated circuit would continue to double, at constant prices, every year for the next 10 years. He reassessed his prediction in 1975, increasing the doubling interval to 18 months. In short, constant technological advances are reducing the costs of producing electronics and making them increasingly powerful.

Semiconductors are now found in many areas. The telecom and computer sectors are still the most important for the industry, but new applications have allowed semiconductors to penetrate the automotive industry, the industrial sector and the consumer products sector, especially household appliances. Moreover, their presence as a percentage of a product’s added value tends to increase over time. We need only think of the proportion of electronic circuits in a smart building or a new car, which is very different from what it was in the early 2000s.

Reasons for the Industry’s Cyclicality

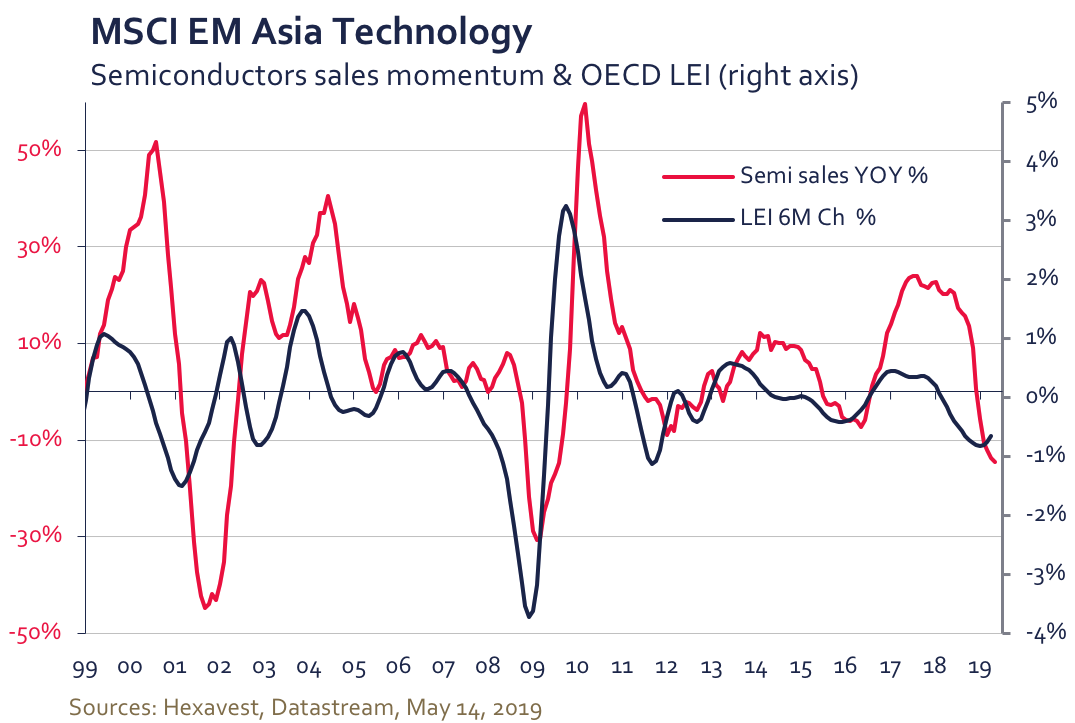

Beyond their structural growth, semiconductors and electronic components follow pronounced cycles, as shown in the graph below.

We believe there are several reasons for this cyclicality:

- The high proportion of demand from the telecom and IT sectors, which are sensitive to investment cycles.

- The technological cycles of customer industries, such as the move to 4G for cellphones, video game consoles and computers, which involved a new generation of graphics cards and memory.

- The technological cycles inherent to semiconductors.

- The fact that investment in new plant is a long and costly process; when the economic cycle slows sharply, overproduction is significant, occurs almost immediately and drives up inventories.

Throughout the cycles, progress and innovation have opened up new horizons, and we think the coming decades will be no exception.

Awaiting the Arrival of 5G

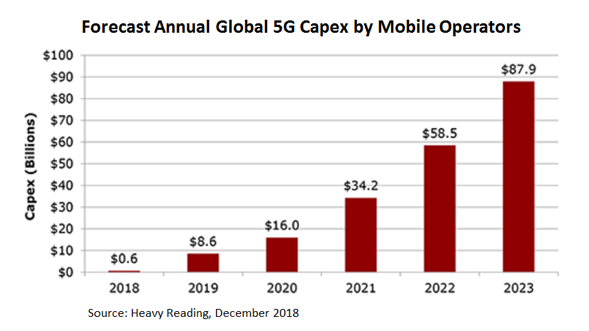

Even though the transition to 5G is already under way, we do not think this technology will soon be functional on a large scale. The main improvement with 5G is an increase in the capacity and speed of wireless networks through a higher frequency band. This requires a higher density of communication towers, so their numbers will have to be increased significantly. Telecom operators should face higher costs than for the deployment of 4G, at a time when 4G has just entered its monetization phase. This financial issue risks dampening some operators’ enthusiasm.

If 4G-related improvements have allowed real-time video to be streamed on our mobile devices, 5G should achieve a higher level of quality, close to the speed of wired networks. For now, few applications require such high speeds.

On the industrial side, the arrival of 5G will likely have many implications for the technology supply chain. R&D is continuing with a view to reducing costs and accelerating deployment. Communication towers continue to be deployed, creating demand for various electronic components. Smartphones need more efficient components (processors, batteries, memory, cameras, etc.). When the large-scale deployment of 5G takes place, it should result in a new growth cycle for these devices.

In addition, 5G opens the door to more numerous and increasingly complex exchanges between individuals and electronic devices, not to mention a proliferation of connections between electronic devices in the form of the Internet of Things (IoT). Even though we can already control a number of home automation functions from our smartphones, it’s still early days. The needs of businesses, plants, cities and governments, which seek monitoring, control, protection and data-exchange functions, represent a structural trend. The increasingly commonplace use of the cloud has led to an explosion in data exchanges globally. In our view, the advent of more efficient mobile networks will accelerate this trend over the next decade. Ultimately, we believe 5G will be an important growth driver for the technology sector.

The Imminent Impact of Smart Cars

Cars contain an increasing number of electronic components, a trend that is no longer limited to luxury models. In fact, today’s cars already incorporate functions that correct human errors, such as autonomous brakes. We believe the arrival of hybrid and electric vehicles will accentuate this trend. They require increasingly efficient and complex batteries, not to mention numerous sensors to control the engine’s power supply and mechanical functions that have become electric. In short, the electronic content of our cars should increase significantly in the short term.

Even though global growth of car sales is anemic, the use of electronic components by this industry is expected to continue growing.

A Structurally Attractive Theme but Timing Is the Challenge

We made the case that the growth drivers of the technology supply chain are no longer limited to phones and computers: the end markets and their level of growth are increasingly numerous and varied. Thanks to innovation, other applications will likely continue to emerge: self-driving cars, the Internet of Things, smart homes, artificial intelligence, virtual reality and so on.

There is no doubt in our minds that the technology sector is an almost unavoidable structural theme. This highly cyclical sector is in a slowing phase, and we believe that securities with reasonable valuations can already be found in Asia’s emerging markets. To take full advantage of the next growth wave in this sector, we are looking for the next attractive entry point.

Source of all data: Hexavest as at June 30, 2019, unless otherwise specified. The returns of the MSCI indices are presented net of deductions from foreign withholding taxes. MSCI data presented may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and have no liability hereunder. Past performance does not predict future results.

This material is presented for informational and illustrative purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any particular investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.