Are we simply delaying the inevitable?

March 14, 2022

Investors’ concerns about the impending tightening of financial and monetary conditions were replaced by concerns related to the sharp rise in geopolitical tensions in February that culminated with the Russian army making its way into Ukrainian territory.

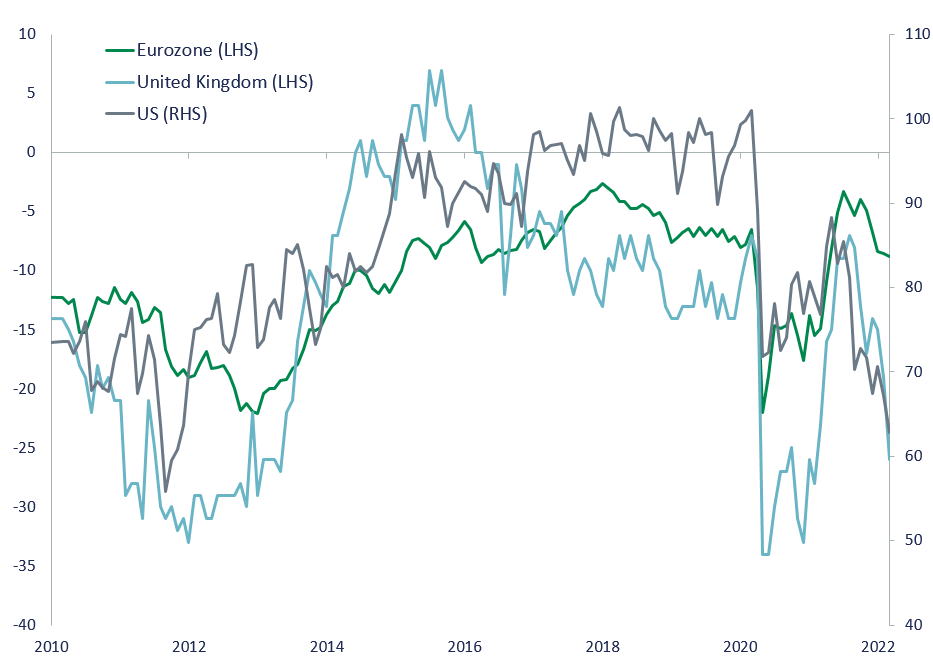

While the political and humanitarian crisis is unfolding in eastern Europe, the economic backdrop has been one of recovering activity after the lull imposed by the Omicron wave in late 2021 and the beginning of the new year. The February PMI readings in both the US and Europe rose unexpectedly as the service component picked up steam much faster than anticipated. The Eurozone composite PMI index bounced back to its highest level since September 2009, a welcome development after the 5 monthly declines in the previous 6 months. At the same time, price pressures have not let up, with US annual headline inflation reaching 7.5% in January.

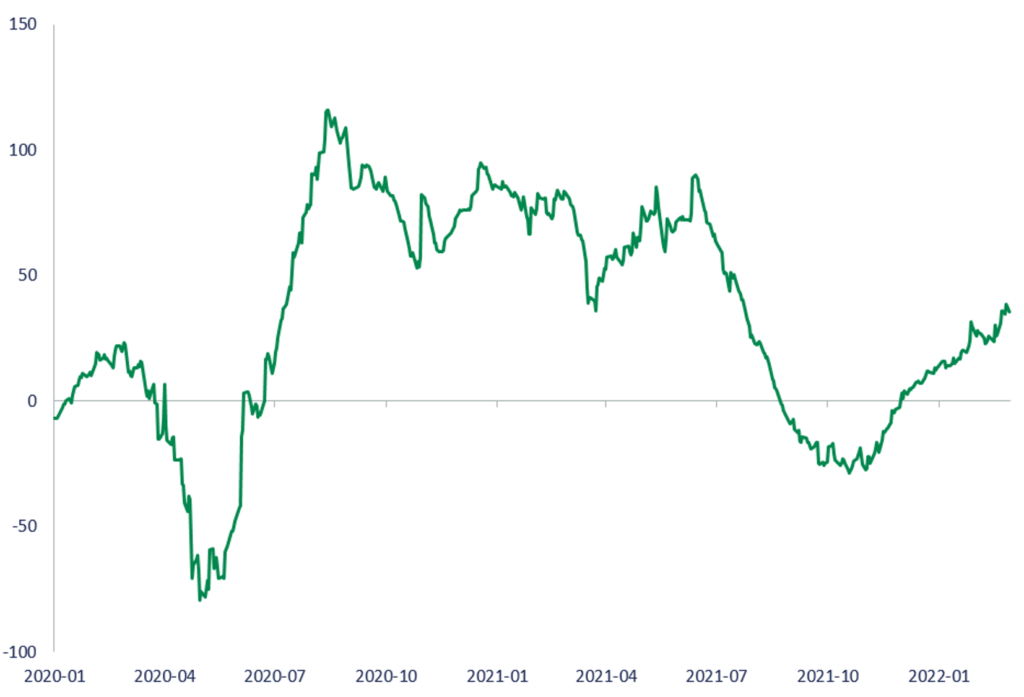

Citigroup Economic Surprise Index (Global)

Sources: DGAM, Bloomberg, as of February 28, 2022

Several governments have announced an easing of COVID related restrictions. In the UK, Prime Minister Boris Johnson declared that England's remaining COVID restrictions would be lifted and that people who test positive will no longer be legally required to isolate, but will be expected to exercise personal responsibility.1 The Danish government had made a similar statement a few weeks earlier. Removing the restrictions will provide a boost to economic activity but likely won't be enough to offset the challenges ahead. One such challenge is weakening consumer confidence, which has proved to be vulnerable to persistently high inflation.

Consumer Confidence Hit by High Inflation

Sources: DGAM, Refinitiv, as of February 28, 2022

Amid geopolitical tensions, investors are downplaying the probability of an aggressive move by the US Federal Reserve. A 50 basis points (bps) rate hike was all but priced in the futures market by mid February, but recent developments in eastern Europe have pushed the odds back in favour of a smaller 0.25% increase. However as the current domestic economic backdrop remains one of growth with persistent inflationary pressures, some policymakers continue to argue for decisive action by the Federal Open Market Committee (FOMC)2. The next FOMC meeting will take place on March 16, and the most likely outcome will be a cautious rate hike as the committee assesses the impact on the US economy of both Russia's invasion of Ukraine and the ensuing government response.

Some investors see the ruling out of a more aggressive 50 bps rate hike in March as a reprieve. At the end of the day, the negative impact of the war in Ukraine on the US domestic economy will most likely be limited. Thus, the inflationary pressures should remain, and while equity investors may get a small break from the FOMC in March, it is simply delaying the inevitable: the higher rates needed to tame inflation.

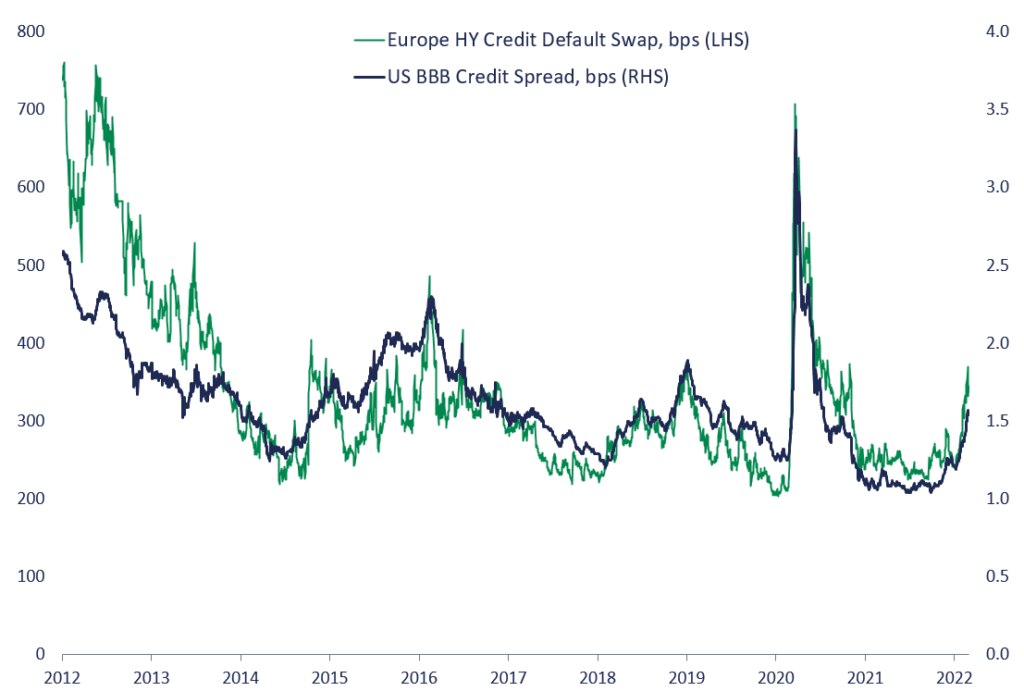

We continue to monitor the credit market for signs of stress that could ultimately weigh on economic growth. So far, the yield increases have been controlled. While spreads remain low by historical standards, the level of indebtedness in the global economy is much higher today, which suggests a greater sensitivity to higher rates. As a result, larger financing costs and lower credit availability will, in due course, harm economic growth.

Credit Spreads

Sources: DGAM, Bloomberg, as of February 28, 2022

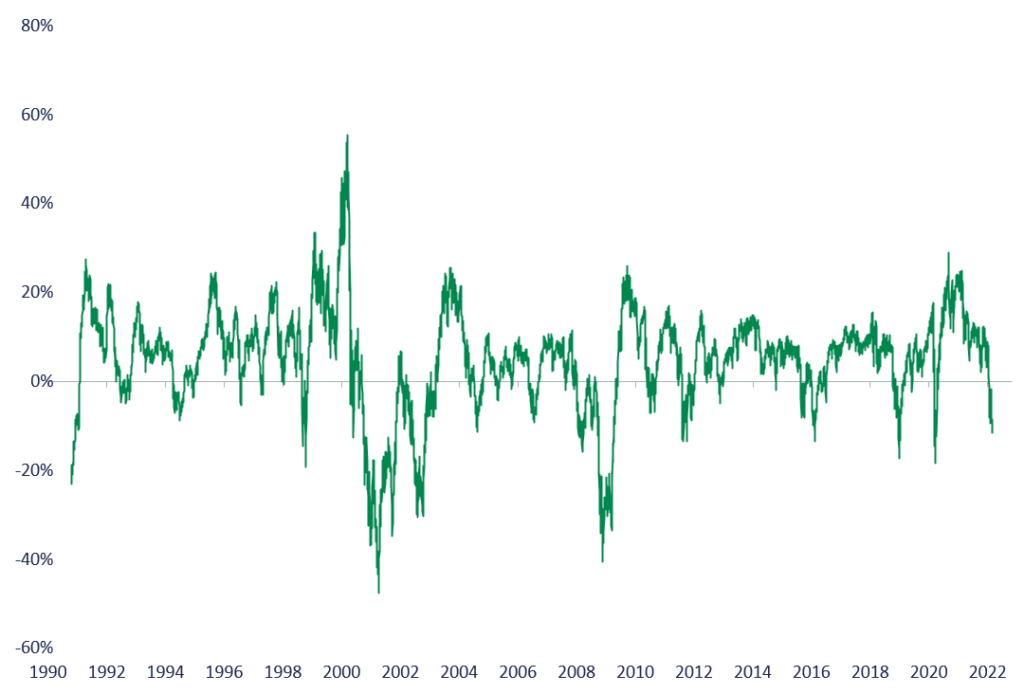

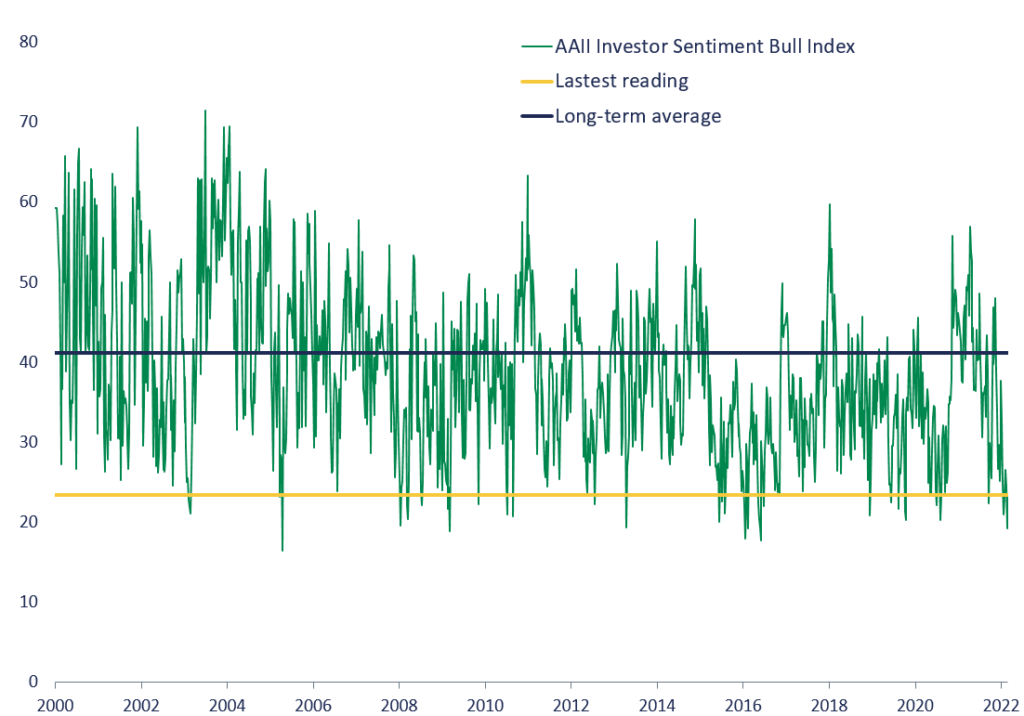

After a volatile start to the year, retail investors seem to have lost confidence, with the American Association of Individual Investors (AAII) sentiment bull index falling to a level that is rarely observed and with key indices moving past key support levels. The depressed indicators suggest that a short-term rebound is likely, but that longer term prospect for equities remains negative as holdings are still elevated.

Composite Index: Deviation from 200-day Moving Average

Sources: DGAM, Refinitiv, as of February 28, 2022

American Association of Individual Sentiment Bull Index

Sources: DGAM, Refinitiv, as of February 28, 2022

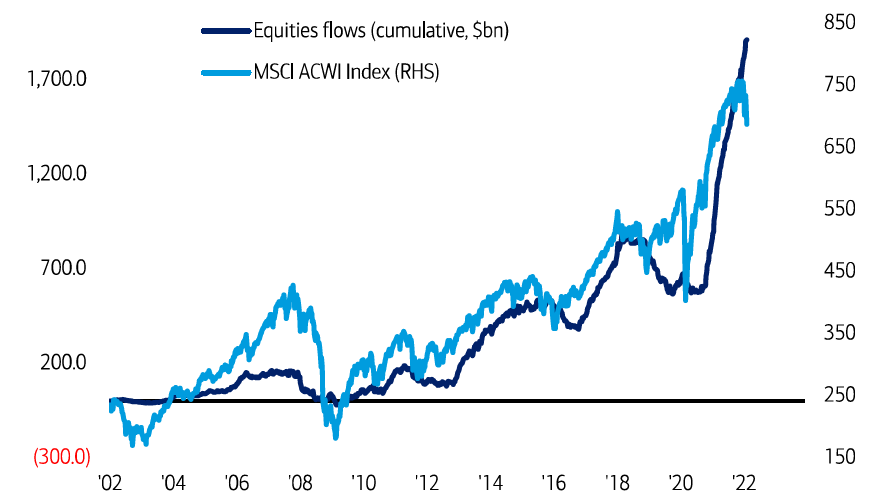

Interestingly, despite sluggish investors sentiment readings, equity fund flows have remained positive amid rising uncertainty surrounding financial markets3.

Flows and Price Disconnect

Equity flows, cumulative in $G vs MSCI ACWI Index

Sources: BofA Global Investment Strategy, Bloomberg, EPFR, as of February 24, 2022

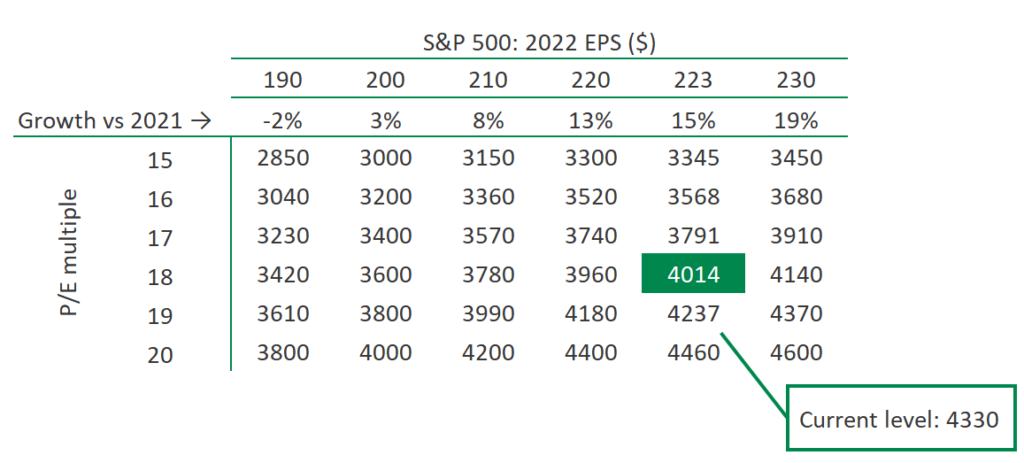

At the end of the month, the aggregate valuation of global equities stood at the 88th percentile of the historical range compared to 96 12 months ago. US equities is by far the most expensive market, with the 12-month forward P/E multiple for the S&P 500 Composite index at 20x. This is 11% lower than one year ago but still above the 18x level we would expect with a US 10-year treasury yield near 2%. Using the current level of expected earnings for 2022 along with the multiple implied by a 2% treasury yield, we extrapolate a fair value for a US equity benchmark of approximately 4000.

S&P 500 Expected Earnings for 2022

Sources: DGAM, Bloomberg, as of February 28, 2022

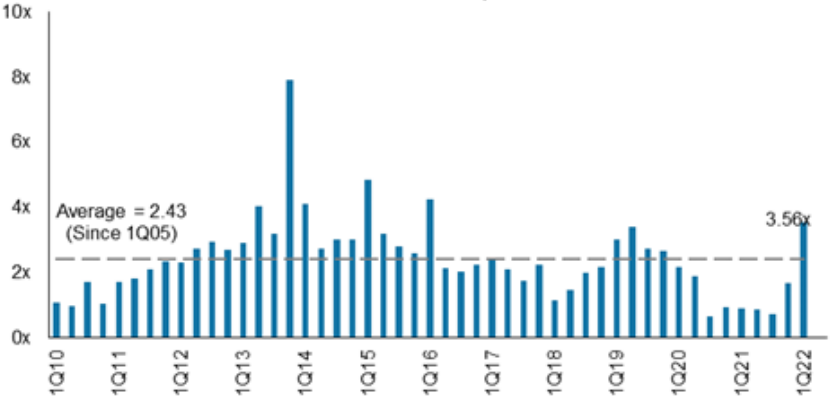

It is worth noting that earnings growth expectations are elevated despite decelerating growth, profit margin headwinds and rising geopolitical uncertainty. Considering the long list of challenges, the risks to earnings growth in 2022 are skewed negatively, adding further downside risks beyond what could be considered fair value at the moment. The recent jump in the ratio of negative to positive guidance suggests as much4.

Ratio of Negative to Positive Guidance Ratio has Spiked in Q4

S&P 500 guidance relative to consensus expectations

Ratio at T-4; T=0 is end of quarter

Sources: Factset, Morgan Stanley Research, as of February 28, 2022

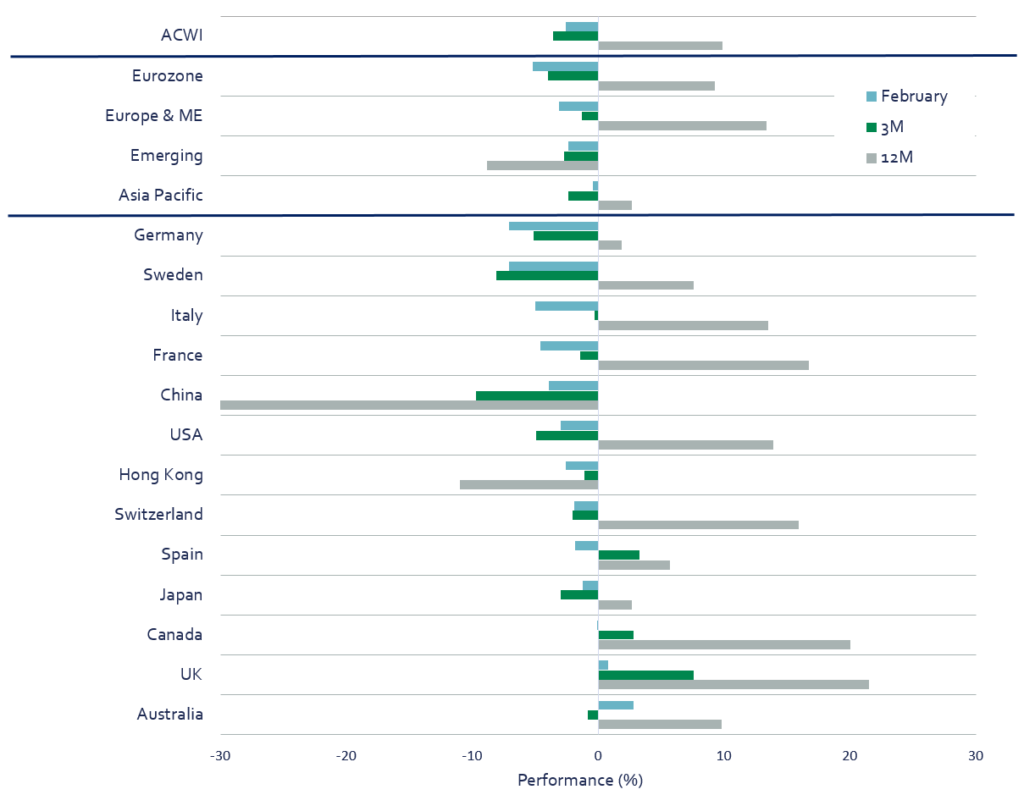

Market performance

MSCI ACWI Index: Country and Regional Returns

Total returns for 1M, 3M and 1Y as of February 28, 2022

Sources: DGAM, Refinitiv

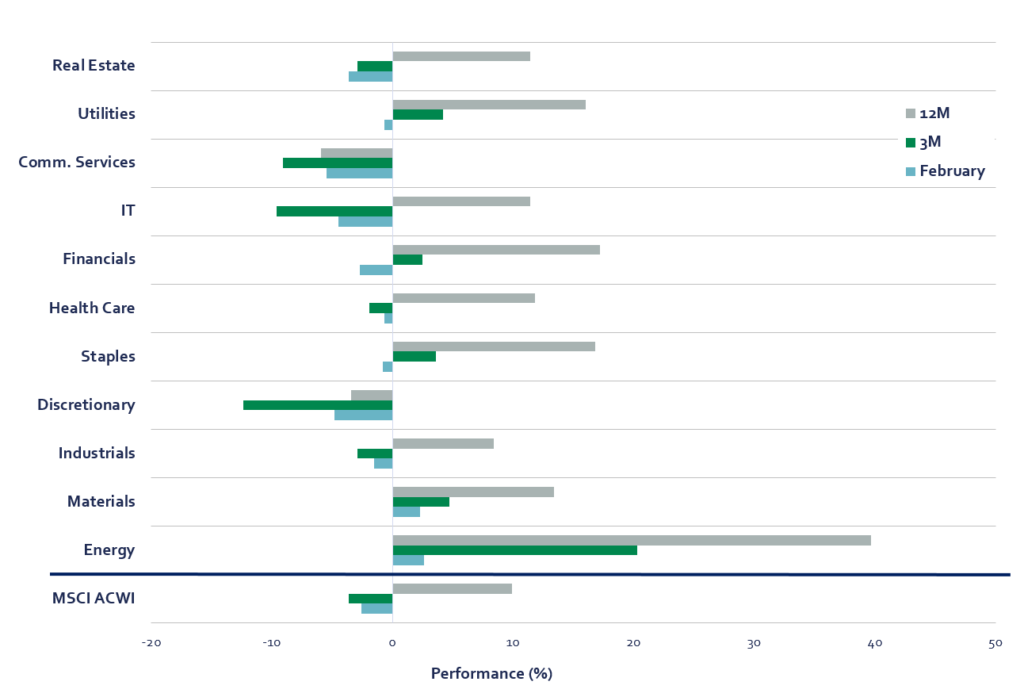

MSCI ACWI Index: Sector Returns

Total returns for 1M, 3M and 1Y as of February 28, 2022

Sources: DGAM, Refinitiv

Conclusion

We continue to remain cautious, since we expect equity markets to follow the path set by the weakening fundamental backdrop, above and beyond the war in Ukraine. However, we also expect to take advantage of opportunities that may arise in the current volatile environment.

Sources :

1. Boris Johnson scraps remaining COVID restrictions in England – POLITICO

2. Fed’s Waller says bigger rate hike in March may be needed | AP News

3. The Flow Show: If it walks like a bear…, BofA Global Research, 24 février 2022.

4. Weekly Warm-up: Avoid the Blind Spot and Look for Operational Efficiency, US Equity Strategy, Morgan Stanley, 28 février 2022.

Important Information and Disclosure

Source of all data and information: DGAM and MSCI as of February 28, 2022, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of DGAM at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, DGAM does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. DGAM disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

All references to the “Hexavest ACWI equity portfolio”, to the “ACWI Equity representative portfolio”, to the “portfolio”, or to their performance in this document refer to an actual portfolio managed by DGAM which is used to objectively represent the firm’s Global ACWI Equity strategy. The performance of this representative portfolio has been included in Hexavest’s ACWI Composite (Composite) since its inception in 2014. The Composite includes portfolios that invest primarily in equities of companies located in the developed markets and emerging markets of Americas, Europe & Middle East, and Asia Pacific. DGAM uses an investment approach that is predominantly “top-down” to construct diversified portfolios that typically contain more than 275 stocks. Asset allocation between regions, countries, currencies, and sectors can deviate substantially from that of the benchmark. Some portfolios may invest a small portion of their assets in countries and currencies not included in the benchmark. A client’s actual holdings, performance and investment experience will be different from that shown.

Gross-of-fee performance results are presented before management and custodial fees but after all trading commissions and withholding taxes on dividends, interest, and capital gains, when applicable. Such fees and expenses would reduce the results shown. Fee levels may vary from client to client depending on the portfolio size and the ability of the client to negotiate fees.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and DGAM assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all DGAM’s recommendations have been or will be profitable. Investing entails risks and there can be no assurance that DGAM will achieve profits or avoid incurring losses. It should not be assumed that any investor will have an investment experience similar to returns shown.

This material is for the benefit of persons whom DGAM reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of DGAM.