ESG factors applied to emerging markets: A top-down case study

Even though Hexavest takes ESG factors into account in all its activities, each regional team faces specific issues. Our Vice President, Responsible Investing, discusses the challenges and specificities of investing in emerging markets with one of our portfolio managers.

January 29, 2020

Jean-Christophe, the emerging markets team has made a sustained effort to analyze ESG factors in recent months. This use of your time is not surprising; we know that a number of emerging countries are marked by corruption and that corporate disclosure practices are often opaque. How do you deal with this lack of transparency that is part of your reality?

When you manage a portfolio of emerging market (EM) equities, nothing is all white or all black. You have to distinguish light grey from dark grey; you have to put things in perspective, encourage best practices, detect inflection points and take the long view rather than follow trends.

We’ve recently met with companies that have suddenly discovered an ESG vocation: is it a step in the right direction, a marketing stratagem or a deceptive description? Even when asking the right questions, it can be difficult to discern the reality of companies on the ground, at least for those operating in countries that don’t promote transparency. It’s clear that some emerging countries are well-known for pollution, corruption, poor working conditions or oppression of minority shareholders, so we can’t give companies the benefit of the doubt.

In our view, the main challenge of investing in emerging markets is the diversity throughout the investment universe in terms of rules depending on (1) the country’s level of economic development, (2) its pace of growth, (3) its main industries and (4) its political regime and regulatory context.

We also note varying levels of investor double-standard depending on the country. For example, Western analysts and media tend to be more lenient toward a democratic country, such as India, that takes a step in the wrong direction. These same people may show an unforgiving attitude toward an undemocratic country, such as China, that would be heading in the same direction. This complacency can skew our reading of ESG risks, so we have to deal with such information in a rational manner and look for objective sources.

Undoubtedly, our top-down approach is useful when it comes to analyzing systemic ESG risks.

And what about the ESG data we’ve been hearing so much about? We know that data quality is a concern for most investors who want to abide by the principles of responsible investing. But, before we even talk about quality, I think we should address availability in the case of emerging markets. Would you say that data availability or quality is an obstacle to including ESG factors in your investment process?

ESG data are available and accessible for the vast majority of companies that make up the MSCI ACWI Index. Even so, there’s still a marked difference between developed and emerging countries. We currently use three ESG data providers, which give us access to data for about 99% of the companies in developed countries. For emerging markets, the coverage falls to 86%.

But, in our opinion, the main obstacle is reliability of the data. For example, MSCI recently added to its indexes many Chinese companies that don’t publish reports in English and have no publication history. Fortunately, the major suppliers are gradually refining their methodologies, but there’s still a lot of work to be done in the case of emerging markets. With time, our level of comfort will increase.

What other emerging market issues deserve special attention?

One area of concern is social issues. Just think of working conditions: in developed markets, an investor who considers ESG factors will focus on employee working conditions. In emerging markets, the context is different: job creation takes precedence over improved employee welfare. In our view, authorities in countries such as China, India and Indonesia seek social peace at all costs, which means the priority is creating jobs to lift the majority of the people out of poverty, not workplace safety.

In the eyes of Westerners, the price to pay is sometimes heavy. For example, the strict control over individual freedoms in China and the harsh working conditions in a new manufacturing country such as Vietnam may seem shocking. But we must bear in mind that a number of emerging countries have built their success on low-cost manufacturing, with low wages, limited investment in automation and safety, and so on. Repeated industrial accidents, such as Vale’s dam failures in Brazil, are symptomatic of this reality.

In terms of governance, our goal is not to label countries as “good” or “bad,” but rather to determine the regulatory framework before we invest. Even though information is available, such as the Transparency International’s Corruption Perceptions Index or the World Bank’s Ease of Doing Business Index, our expertise in macroeconomic analysis and knowledge gained from field research provides us valuable insights. Our understanding of global economics and geopolitics is one of the skills that allow us to step back and develop an informed opinion before we make investment decisions.

As a top-down manager, Hexavest takes an approach that enables it to develop clear views on the major systemic ESG issues. Even though environmental issues are global, your team thinks that emerging markets will continue to be hit harder by global warming. Why is the climate emergency of greater concern for these countries?

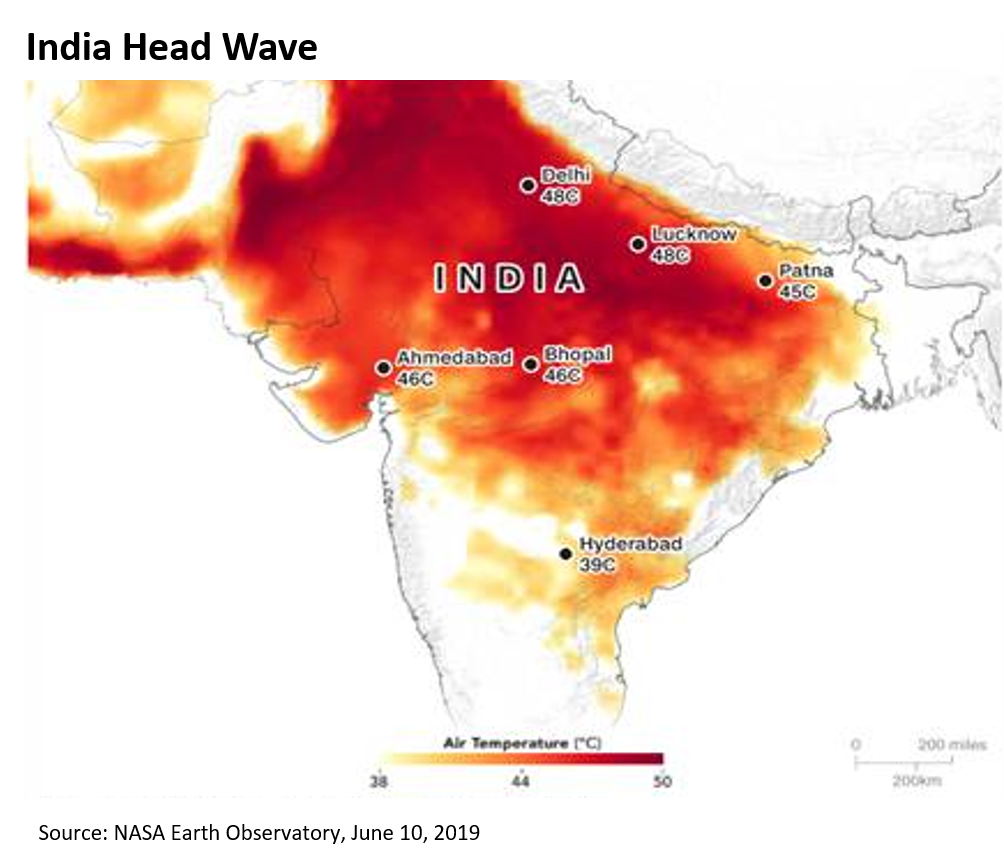

Many emerging countries are in areas already affected by global warming. Some places will quickly become too hot for human life under normal conditions as temperatures exceed 50°C for weeks at a time. This problem will materialize well before 2050. Northern India was hit by the second-longest heat wave on record in 2019; it lasted more than a month, with temperatures reaching 48°C in New Delhi last June. In some cities in the state of Rajasthan, the temperature soared to 50°C. These temperatures are comparable to those observed in Saudi Arabia, but India’s population density is nothing like that of a desert country. If the situation continues to worsen, an increase in mortality rates and large waves of migration can be expected in the next few years.

Moreover, because a large proportion of the people in emerging countries live near the coast, some countries are especially vulnerable to severe flooding and more frequent hurricanes. Such events threaten the lives of hundreds of millions of people, especially in Asia. Countries such as China, Vietnam, India, Bangladesh and the Philippines appear to be especially at risk.

The alternation of drought and torrential rain is becoming more pronounced. This phenomenon can reduce harvests, which has a very significant impact on producing countries, such as Brazil, South Africa, China, India and Indonesia. Populations in the poorest countries, where food expenditure far exceeds 30% of household budgets, are especially vulnerable.

Some studies have attempted to quantify the productivity loss due to global warming. The International Labour Organization estimates that, by 2030, heat stress caused by global warming will reduce productivity by about 2.2% of all hours worked worldwide, the equivalent of 80 million full-time jobs. Not surprisingly, Asia and Africa, which are more exposed to extreme heat and where a significant part of the workforce is employed in agriculture, will be most at risk.

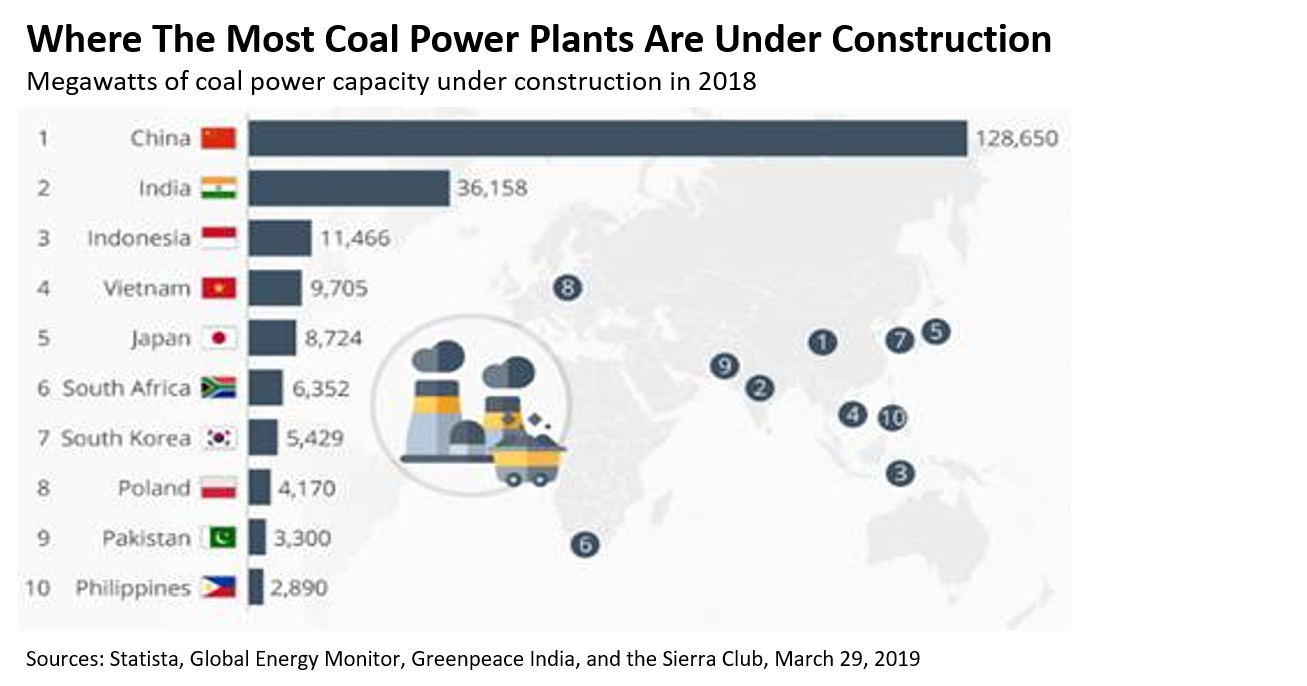

Unfortunately, most emerging countries have not taken sufficient measures to guard against drastic changes. In fact, most of these economies are at an energy-intensive stage of development that emphasizes production at the lowest cost. While developed countries are reducing their energy consumption per unit of production, and their populations are becoming aware of global climate issues, emerging countries, particularly China and India, continue to build coal-fired power plants. As a result, China’s coal-fired generation capacity was 972,514 megawatts in 2018, with an additional 128,650 megawatts under construction that same year (source: Carbon Brief).

Why is coal doing more damage in emerging markets?

Coal is a significant contributor to global warming, but that isn’t its only adverse effect: when burned in a power plant, it emits sulphur dioxide (SO2) and nitrogen oxide (NOx), which are toxic to humans and cause premature death. In 2017, Climate Analytics had quantified the number of premature deaths in the European Union at an astounding 23,000 a year. But few studies have analyzed the impact in emerging markets. Given that the European Union produces far less coal-powered energy than China and India, and that the regulation of polluting emissions is generally stricter in Europe, we can reasonably assume that the number of deaths is much higher in the emerging world.

The ESG question then simply becomes: Should coal be banned from our portfolios? For some investors, investing in utilities that use coal is justifiable, provided that a company’s development plan calls for rapidly increasing its proportion of renewable energy. We pretty much agree with that idea, but conversely, we think it’s difficult to justify exposure to coal mines. For that reason, we’ve decided to exclude coal mining companies from our emerging market equity portfolios.

Your team has also decided to exclude tobacco stocks. Emerging markets are clearly the latest growth driver for this industry, and the profit growth outlook is still positive. Why did you decide to exclude this theme from your portfolios?

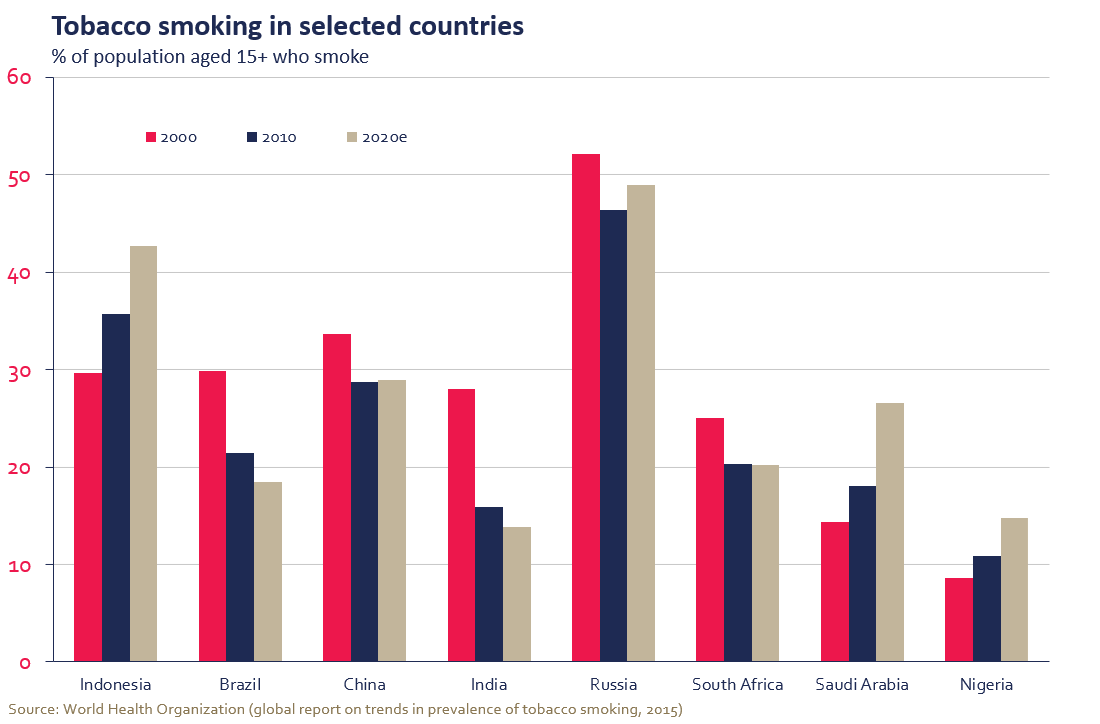

In developed countries, it has become unacceptable to promote cigarettes and inconceivable to see a child smoking on the street. Tobacco use is steadily declining, and it’s reasonable to assume that everyone is aware of the health risks.

Unfortunately, what’s obvious in developed countries isn’t so clear in many emerging countries. The large populations of China, Indonesia and India are less aware of the health risks. Tobacco advertising is still allowed there. Moreover, cigarettes have a strong appeal for young people because smoking tobacco, instead of chewing it, seems to be a symbol of improved social status in India and Indonesia.

These factors have contributed to strong growth of cigarette consumption. The tobacco industry even considers Indonesia as the last El Dorado: You can still see the Marlboro cowboy in Jakarta, 20 years after he vanished from the streets of the United States. A 2015 study cited by the Guardian showed that nearly 80% of the world’s one billion smokers live in low- or middle-income countries, and that people in low-income countries are almost 10 times more likely to be exposed to some form of tobacco advertising.

Therefore, we have eliminated the tobacco industry from our portfolios for ethical reasons. But because the industry offers good growth potential in emerging markets, we have to reallocate our capital tactically or identify similar and equally promising structural themes. Fortunately, there’s no shortage of growth areas in these markets.

In a Financial Times interview last September, Bill Gates expressed the opinion that disinvestment from fossil fuels has no impact on the climate. Do you think his view is well founded?

I think Mr. Gates was making the point that we should stop wasting time and energy trying to exclude the carbon chain and instead focus our investing in new, disruptive technologies, like those that reduce carbon emissions and help people adapt to global warming.

That said, it seems clear to me that most emerging markets need foreign capital and that the divestment movement could affect EM companies involved in fossil fuel production. Our job is to allocate capital in the best possible way. We think it’s better to invest in the technologies of the future, rather than those of the 19th century, which is not far from Mr. Gates’ statement.

We tend to cite ESG risks more naturally than we do opportunities, especially for emerging markets. But is it possible to find opportunities in these markets?

We must never forget our duty to our clients: Any investment involves risk, and a portfolio manager must be aware of the risks that come with any investment decision, whether it involves a sector, an industry, a country or a currency. In this context, even before the environmental aspects, we place a great deal of importance on corporate governance, especially minority shareholder rights. So yes, I think ESG risks outweigh profiting from ESG opportunities.

Nevertheless, we meet with dozens of companies every year, and during these meetings we discuss ESG aspects. We have often come away disappointed, such as in obvious cases of greenwashing*, but we’ve also encountered companies that have really taken account investor concerns related to transparency, corporate governance, a reduced carbon footprint, etc. We recently decided to keep a company in the portfolio despite its high ESG risk, because we expect that it will improve quickly on that front.

As far as countries are concerned, it’s clear to us that governments have become aware that sustainable economic improvement requires tangible reforms, simplified trade practices, as well as independent regulators and central banks. Perceived by investors as less risky, some countries are now benefitting from structurally lower interest rates and better access to international capital. But experience has taught us that such changes are a long time coming and that rapid progress is rare.

NOTES

*Greenwashing is the process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound. Greenwashing is considered an unsubstantiated claim to deceive consumers into believing that a company’s products are environmentally friendly. (Source: Investopedia)

Source of all data and information: Hexavest as at December 31, 2019, unless otherwise specified.

This material is presented for informational and illustrative purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any particular investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.